Accidents can occur even to the most attentive drivers. While the camper is under your care, you are responsible for any damage, including that caused by uncontrollable events such as extreme weather, vandalism, or collisions while the vehicle is parked.

Camper Insurance and Excess Packages

All our campervans are insured through Camplify, which offers excess reduction packages to help minimise your financial liability in the event of damage, whether it’s accidental or caused by external factors.

Accident Excess Reduction (AER) Packages

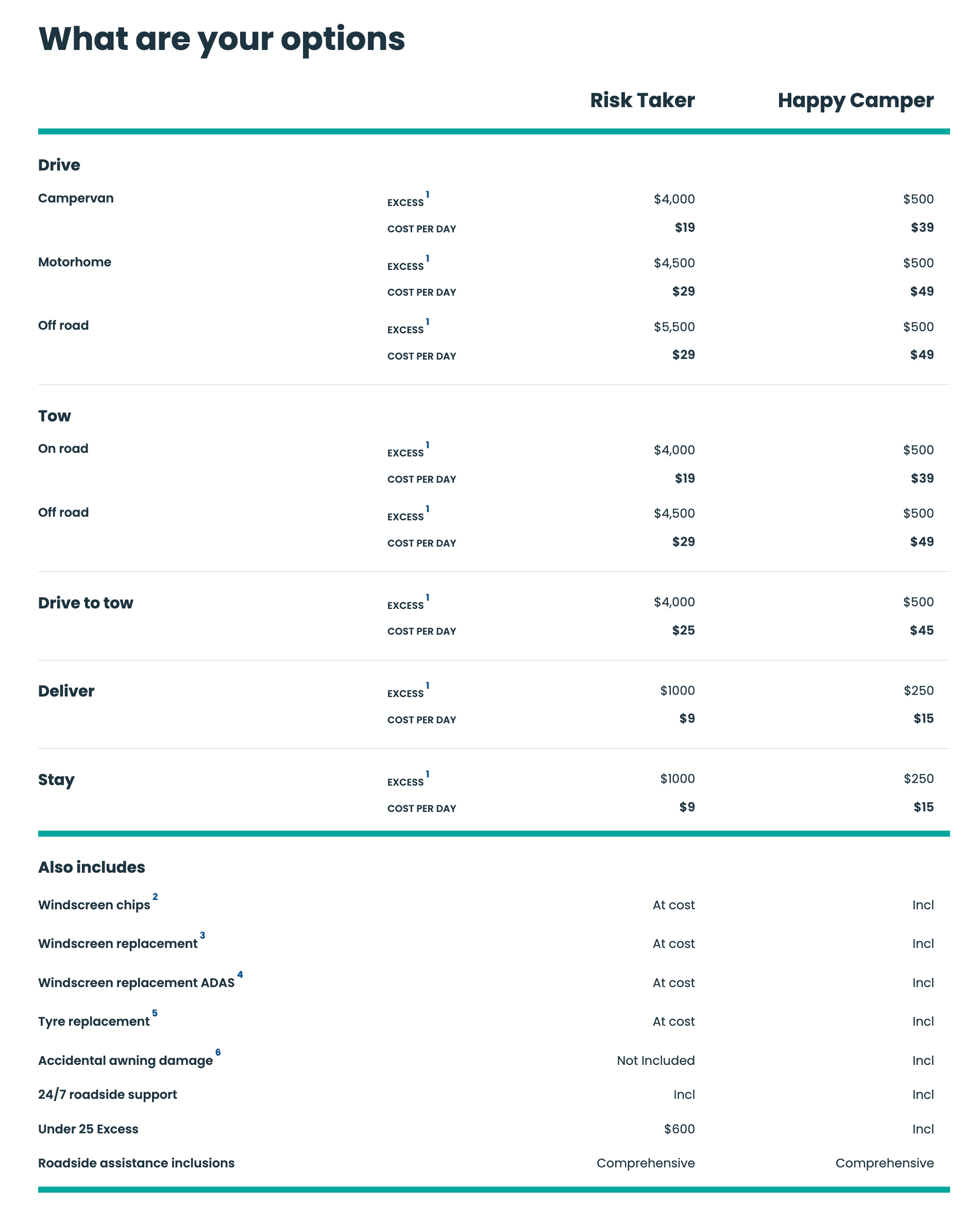

Camplify provides two daily Accident Excess Reduction (AER) packages to help reduce your excess costs:

- Risk Taker – $19 per day

- Basic Coverage: This is the default insurance package.

- Higher Excess: Comes with an excess fee of $4,000 per incident for campervans.

- Happy Camper – $39 per day

- Enhanced Coverage: This comprehensive package provides greater protection.

- Reduced Excess: Lowers the excess fee to just $500 per incident for campervans.

Package Inclusions Comparison

Real-World Example:

You park the camper overnight in a public car park. During the night, another vehicle clips the rear bumper while reversing and drives off. There’s no note left and no third party details.

The damage is cosmetic but real. Cracked bumper corner, broken tail light, and scraped panel. The vehicle is still drivable, but repairs are required.

The owner obtains a repair quote and invoice for $2,800.

Because this is accidental damage caused by an unknown third party, it falls under standard accident damage, not a windscreen or tyre exception.

With the Risk Taker package, you are liable for up to $4,000. You pay the full $2,800 repair cost.

With the Happy Camper package, your liability is capped at $500. You pay $500 and Camplify covers the remaining $2,300.

This is where excess reduction actually matters.

Key clarification:

Windscreen chips, full windscreen replacements, ADAS calibration, and tyre replacements are charged at cost, regardless of excess package. The owner must provide the invoice and the renter only pays the actual repair cost.

Excess reduction applies to accidental damage, vandalism, weather damage, or collisions where repairs exceed normal wear and tear and are not excluded items like glass or tyres.

Important Notes:

- The excess amounts shown are the maximum per event/incident caused by accidental damage.

- If the authorised driver is under 25, an additional $600 excess applies with the Risk Taker package.

- Windscreen chip coverage only applies to chips that do not affect the roadworthiness of the vehicle. If the chip is bigger than a 1 dollar coin and in the driver’s line of sight, most replacement companies will advise on a full windshield replacement.

- Modern vehicles with safety features like lane departure and forward collision control have more expensive windscreens requiring calibration when replaced.

- Tire coverage does not include damage resulting from misuse or breach of hiring terms.

- Awning damage due to misuse or failure to take reasonable precautions during adverse weather will be treated as a breach of hiring terms.

By selecting the appropriate excess package, you ensure a safer and more enjoyable experience, knowing that you are well-protected against unforeseen circumstances.